Course overview

1. What is forex?2. Major and minor forex pairs3. How do you trade forex?4. Key features of the forex market5. How do leverage and margin work?6. Using risk management in forex7. Conclusion2. Major and minor forex pairs

The US Dollar (USD) is the world's reserve currency, with its strength or weakness significantly influencing other currencies and affecting global trade and investment.

Major pairs, led by the USD, account for over 70% of daily trading volume and feature stable economies in combinations like EUR/USD, USD/JPY, and GBP/USD.

Minor pairs, excluding USD, involve major currencies like EUR/GBP, EUR/CHF, and CHF/JPY, offering decent liquidity and volatility.

Exotic pairs include major and developing market currencies such as TRY, MXN, and ZAR, which are less liquid and more volatile, making them riskier but potentially providing more opportunities.

Example

Forex Example:

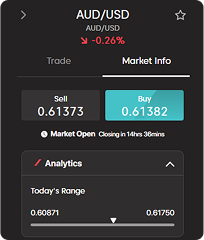

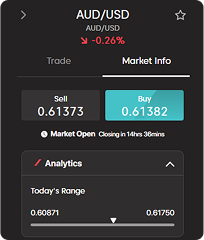

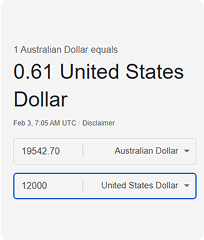

Mark, an Australian, plans a vacation to the US and exchanges Australian dollars for US dollars.

A geopolitical conflict drives investors to seek safe-haven assets like the USD, resulting in a strengthening USD value against the AUD.

Mark returns home without spending any cash, but upon converting his USD back to AUD, he finds that he now has more money than he initially started with.

Quiz

1/2

What are exotic currency pairs known for?

B) High volatility and low liquidity

C) Low volatility and low liquidity

D) High volatility and high liquidity