Course overview

1. Investing in stocks vs. trading share CFDs2. What is the earnings season and how does it affect the price of shares?3. Trading the stock market: So, how does it work?4. Trading on Initial Public Offerings5. Putting your stock-trading strategy into action6. Using risk management in share trading7. Conclusion2. What is the earnings season and how does it affect the price of shares?

There are certain financial events during the year that could cause price swings, and the earnings season is one of them. Earnings season takes place four times a calendar year, two weeks after the last month of the quarter. During that time, the majority of publicly listed companies disclose their quarterly earnings. Earnings reports reveal a lot about a company's fundamentals and may contain tradeable information that affects the stock market. Read more about the earnings season.

Here’s how to trade the earnings season with Axi

- Check the earnings calendar for upcoming reports by companies such as AMZN, NFLX, and GOOGL.

- Track those stock prices closely around earnings announcements.

- Predict announcement vs. positive/negative market expectations.

- Buy or sell based on your prediction.

Example

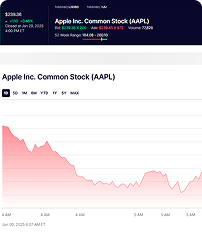

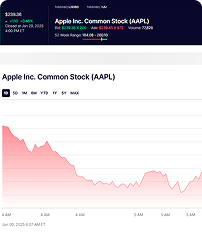

Shares Trading Example

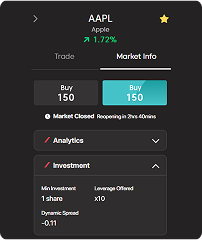

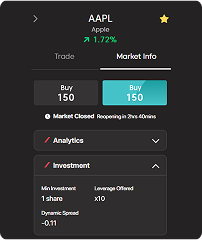

John has $1,500 and wants to invest in Apple stock (AAPL) that is traded on the US Nasdaq exchange.

Using the traditional approach, if Apple stock is worth $150, he would be able to buy 10 shares.

But by trading Apple through share CFDs and the use of leverage, he could trade 200 shares.

Quiz

1/1

How can traders capitalize on the earnings season?

B) By selling stocks of companies that are expected to beat earnings estimates.

C) By predicting whether a company will beat or miss earnings estimates and trading accordingly.

D) By ignoring earnings announcements and focusing on long-term trends